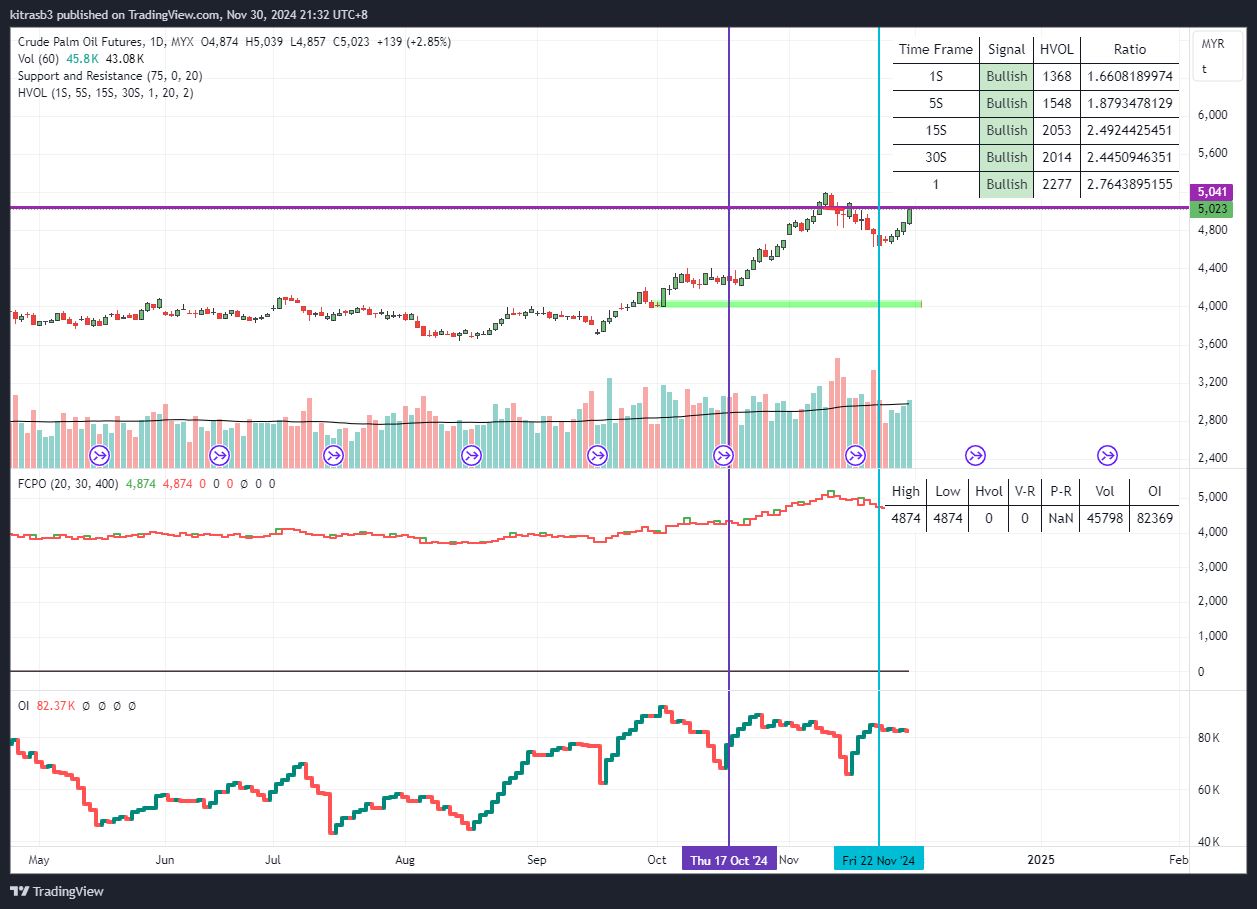

Palm oil price of goes down significantly to current support level while both volume and open interest increase, it generally indicates a few key points:

1. Increased Selling Pressure: The drop in price at the support level with high volume suggests that there is significant selling pressure. Many market participants are selling the asset, causing the price to break through the support level.

2. Confirmation of Downtrend: High volume during a price drop usually confirms the strength of the downtrend. It indicates that the downward move is backed by a substantial number of traders and investors.

3. Rising Open Interest: An increase in open interest means that new positions are being opened. In the context of a price drop, this usually implies that more traders are opening new short positions or there are more new sellers than buyers. This suggests a continuation of the bearish sentiment.

4. Possible Capitulation: If the price is breaking a significant support level with high volume, it could indicate a point of capitulation, where many traders are giving up their positions, possibly leading to further declines before a potential bottom is found.

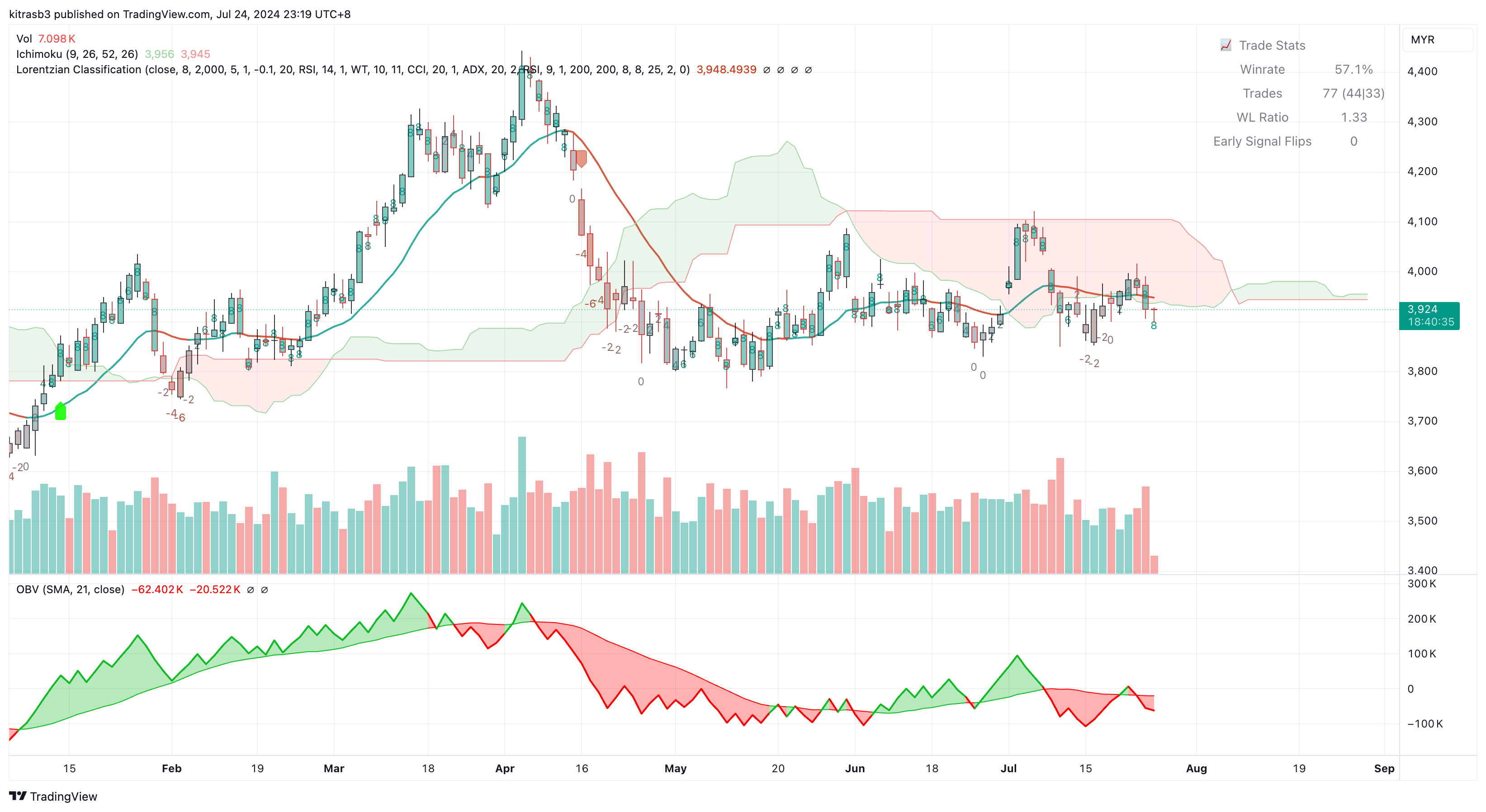

5. Ichimoku Chart Analysis breakdown below cloud increasing the chance of palm oil may go down further.

6. Healthy volume is negative -2825 indicates a heavy selling today.

Overall, the scenario described points to a strong bearish signal, indicating that the market sentiment is negative, and further downside could be expected. Traders and investors should exercise caution and consider the broader market context and other technical indicators before making decisions.