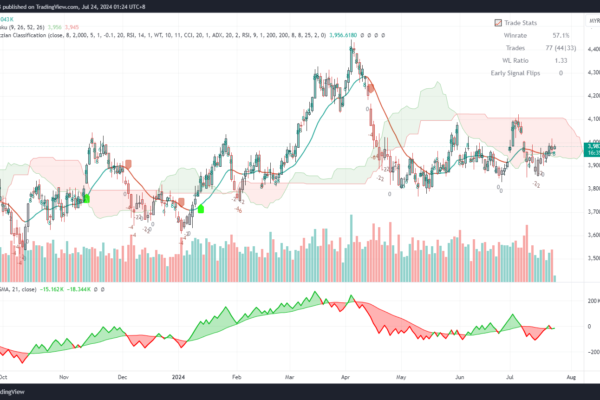

Palm Oil Price Outlook 25-July 2024

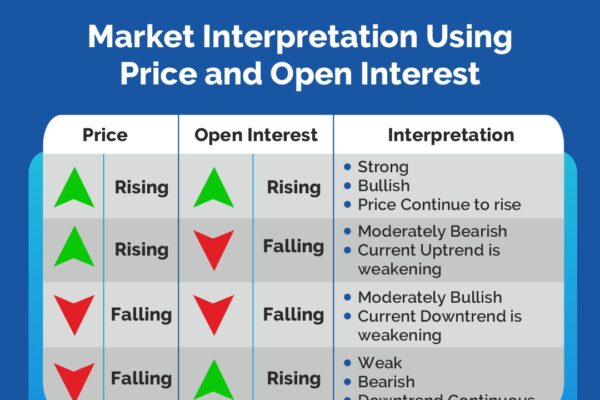

Palm oil price of goes down significantly to current support level while both volume and open interest increase, it generally indicates a few key points: 1. Increased Selling Pressure: The drop in price at the support level with high volume suggests that there is significant selling pressure. Many market participants are selling the asset, causing…