FCPO Closing Report Fri 7th March 2025

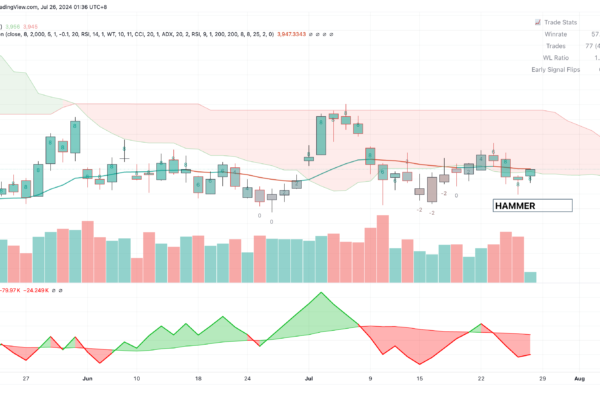

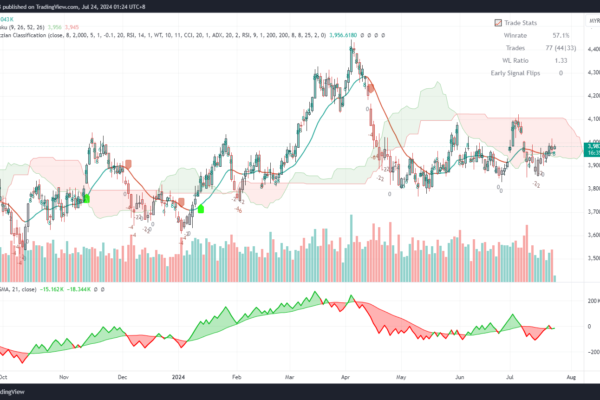

FCPO (Crude Palm Oil Futures) trading, open interest is decreasing, volume is increasing, and price is going up, the likely outcome depends on the underlying market dynamics. Here’s a detailed breakdown: Key Observations: Possible Interpretations: 1. Short Covering Rally (Most Likely) 2. Distribution Phase (Potential Reversal) 3. Temporary Upside Before a Pullback What to Watch…