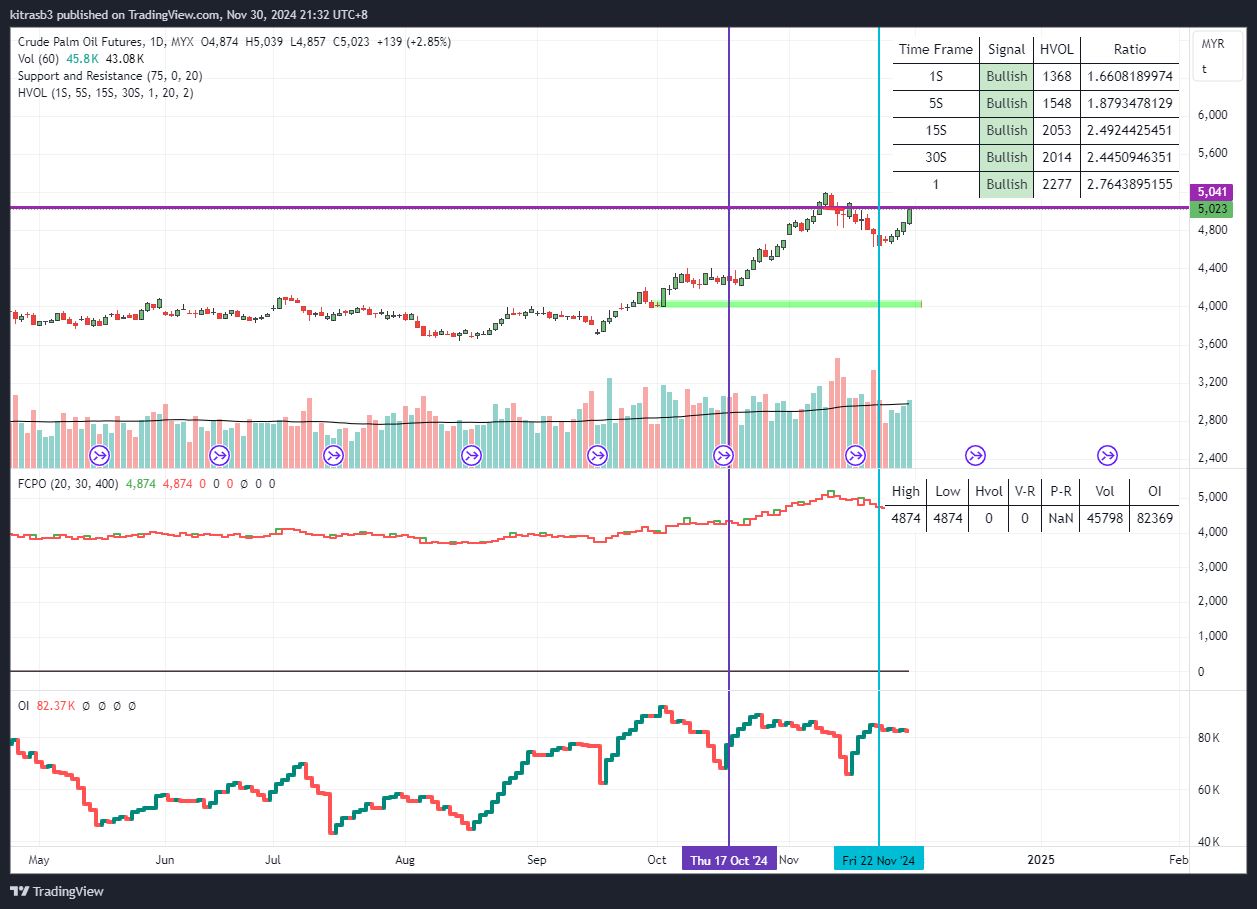

A 2% rise in FCPO (Crude Palm Oil Futures) prices amid a 15% drop in trading volume and a 2% decrease in open interest suggests a few potential interpretations:

- Short Covering or Profit-Taking: The decline in open interest alongside lower volume could indicate short-covering or profit-taking by traders who held short positions. As they close these positions, it creates upward pressure on prices, which could explain the 2% increase.

- Lack of Strong Buying Interest: The significant drop in volume indicates that fewer new participants are entering the market, which might mean the price increase is not strongly supported by broader market sentiment. In other words, there’s an upward price movement, but without much conviction behind it.

- Market Caution or Waiting for Clarity: The decrease in open interest and volume could indicate that traders are cautious, possibly waiting for new information or clearer market signals before committing further. Sometimes, this can be seen during periods of uncertainty about upcoming data or policy changes.

- Technical Resistance Levels: If the market is approaching a technical resistance level, existing participants may be unwilling to increase their exposure, leading to lighter volume. The price may still edge up slightly due to low liquidity or small buying pressure, but this often doesn’t signal a robust trend.

Summary: The combination of a slight price increase with reduced volume and open interest suggests a lack of strong buying enthusiasm. It may indicate short-term gains driven by specific factors, like short covering, rather than sustained momentum. To assess whether this uptrend is likely to continue, it’s worth monitoring if volume or open interest starts increasing in line with the price in the following sessions.