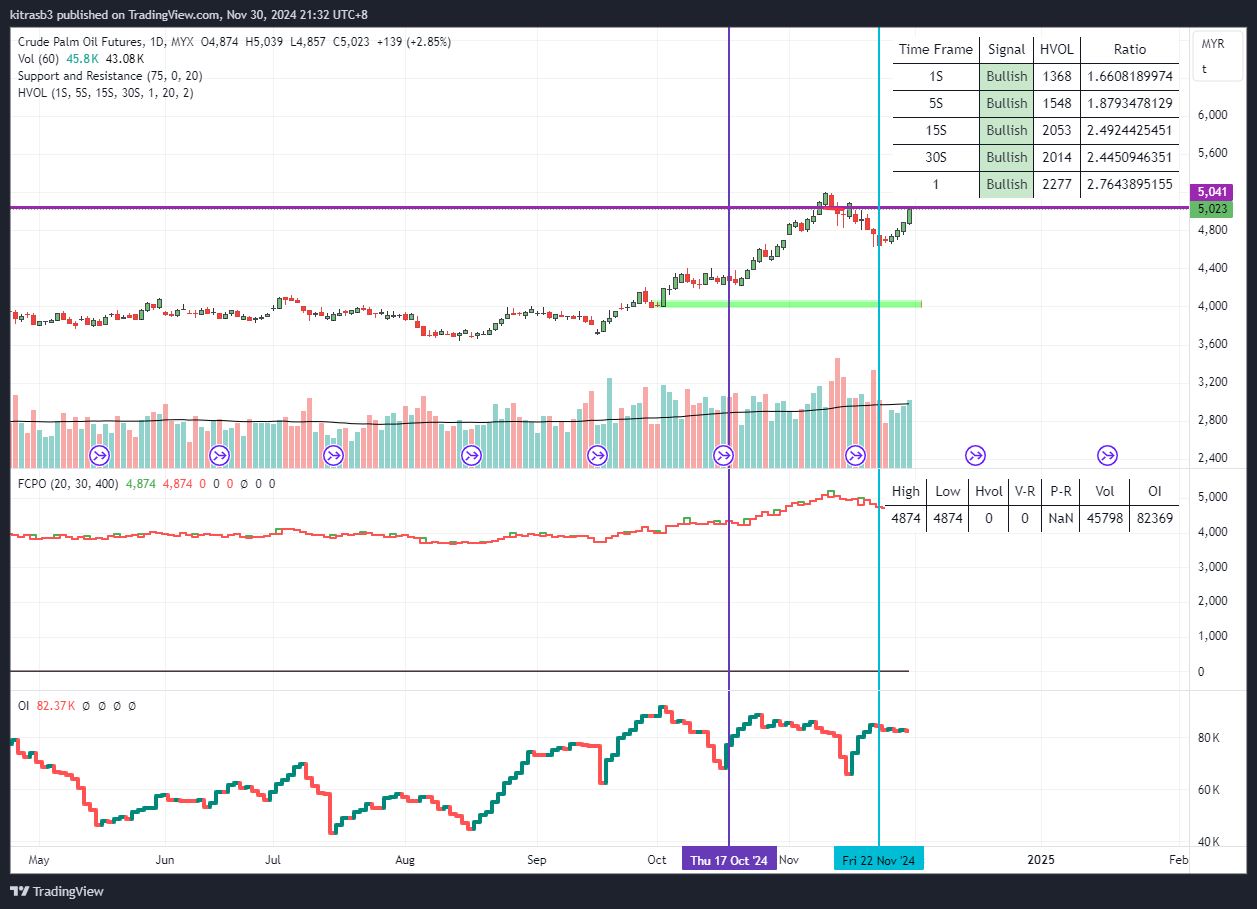

Current Market Dynamics

The palm oil market is currently exhibiting signs of bearish sentiment. Recent trading activity has shown a noticeable decline in palm oil prices from MYR3988 to MYR3967, coupled with a significant increase in both trading volume and open interest.

Key Indicators

- Price Decline: The ongoing reduction in palm oil prices suggests mounting selling pressure within the market. This downward movement indicates that traders are willing to sell at progressively lower prices, reflecting negative market sentiment.

- Rising Volume: The surge in trading volume during this price decline signals a heightened level of activity and interest in the market. Such increased volume reinforces the bearish trend, as it demonstrates a growing number of market participants engaging in selling.

- Increasing Open Interest: The uptick in open interest indicates that new positions are being opened. The rise in open interest alongside declining prices suggests that new short positions are being established. This behavior is a strong indicator that traders anticipate further price declines.

- Healthy Volume also showing negative 270 lots pointing a slight weak sentiment.

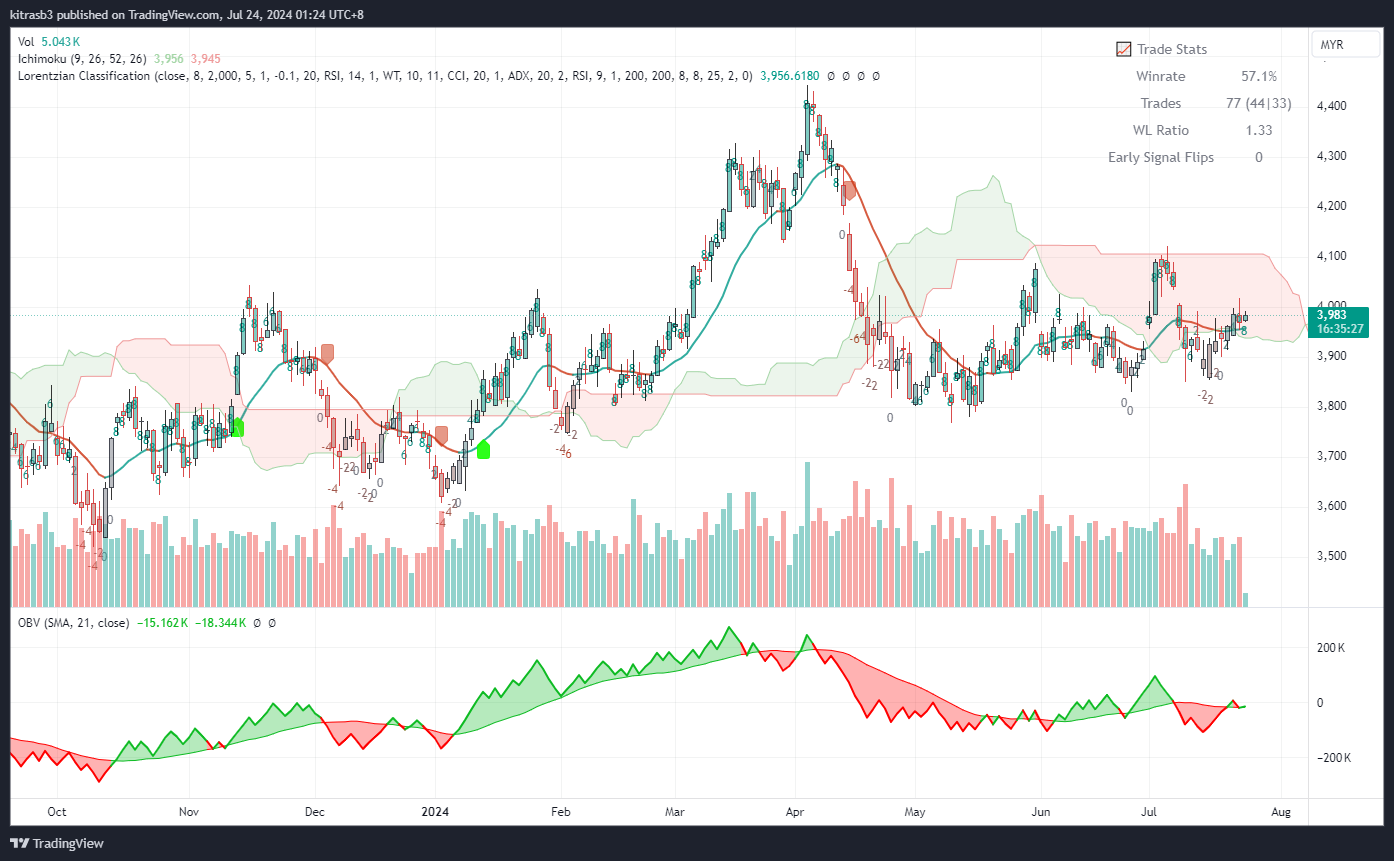

- Ichimoku Chart price is in the cloud which indicates a consolidation mode.

Conclusion

Given the current indicators, the outlook for palm oil prices appears bearish. The combination of falling prices, rising trading volume, and increasing open interest suggests that the market expects further declines. Traders and investors should be cautious and consider these signals when making decisions related to palm oil investments. The market sentiment is clearly tilted towards a continuation of the downward trend in palm oil prices.