Overview:

Recent market activities have shown a concurrent increase in price, volume, and open interest, signaling a strong bullish trend across the observed financial markets. This report provides an analysis of these changes and their implications on market sentiment and future trends.

Details of Market Movements:

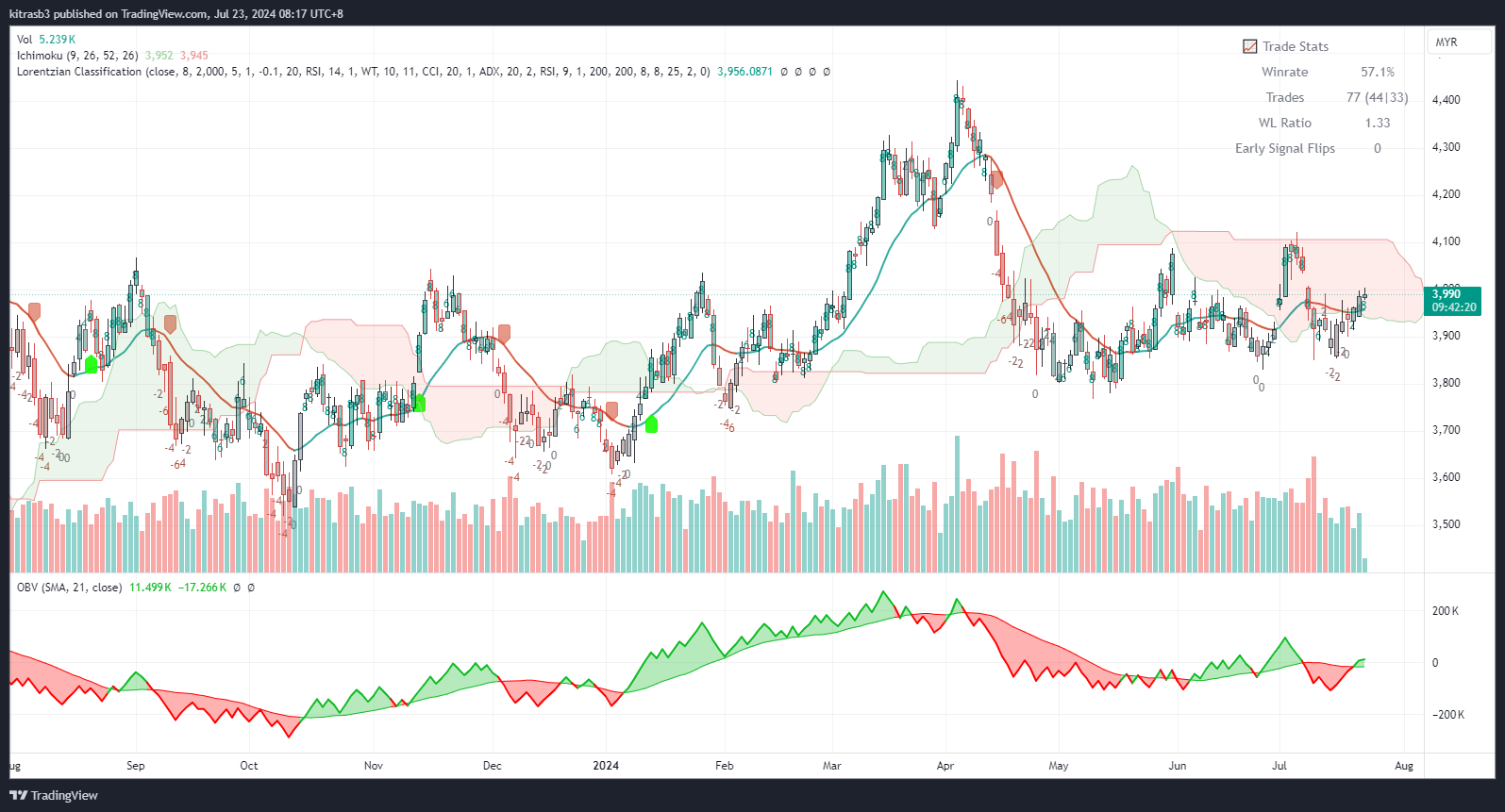

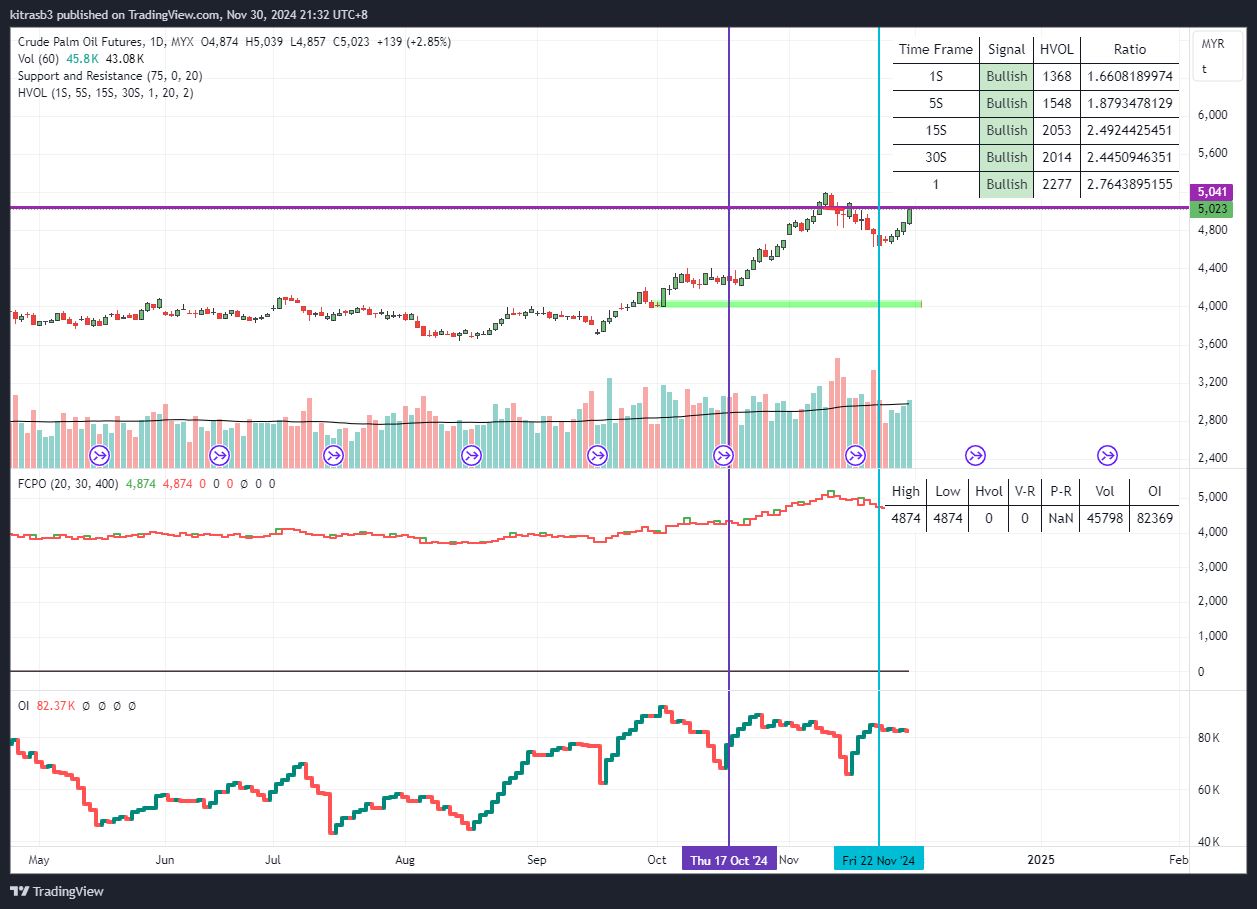

- Price Increase from MYR3960 to MYR3988:

The observed upward movement in prices indicates a strong buyer’s market, where traders are willing to purchase at higher prices, reflecting positive market sentiment and confidence in future value increases. - Volume Increase 18k to 24k :

The significant rise in trading volume accompanying the price increase reinforces the strength of the current price trend. A higher volume indicates more transactions, suggesting that the bullish trend is backed by substantial market participation. - Open Interest Increase 6k:

The increase in open interest denotes that new contracts are being opened, which points to fresh money entering the market. This is a clear indication that investors are not merely speculating but are committing to their positions, anticipating further market gains. - Healthy Volume Decrease 366:

Slight decrease in Healthy Volume based on a formulation indicates seller more than buyer at this price level.

Market Implications:

- Strong Bullish Signal:

The simultaneous rise in these three key indicators (price, volume, and open interest) is traditionally seen as a robust bullish signal. It reflects widespread optimism and active participation, suggesting a sustained upward trend. - Sustainability of Trend:

The increase in open interest, alongside rising prices and volumes, suggests that the bullish trend is not only driven by speculation but also by new investments and commitments to long positions, supporting the likelihood of a durable upward movement. - Strategic Recommendations:

Traders and investors might consider taking advantage of the ongoing trend by entering long positions. However, it is crucial to remain vigilant for any signs of trend reversal or indications of market exhaustion that could signal the end of the bullish phase. Current resistance level around 4060 to 4100 and support 3940.

Conclusion:

The current market conditions, marked by increases in price, volume, and open interest, offer strong evidence of a continuing bullish trend giving probability 75%. Market participants should monitor these trends closely, adjusting their strategies to align with ongoing market dynamics.