The global economy finds itself in a “sticky spot,” according to the International Monetary Fund’s latest World Economic Outlook Update. While maintaining its growth projections, the Fund warns of persistent inflation risks and an increasingly complex policy landscape. This report comes as central banks grapple with the challenge of taming price pressures without derailing fragile economic recoveries.

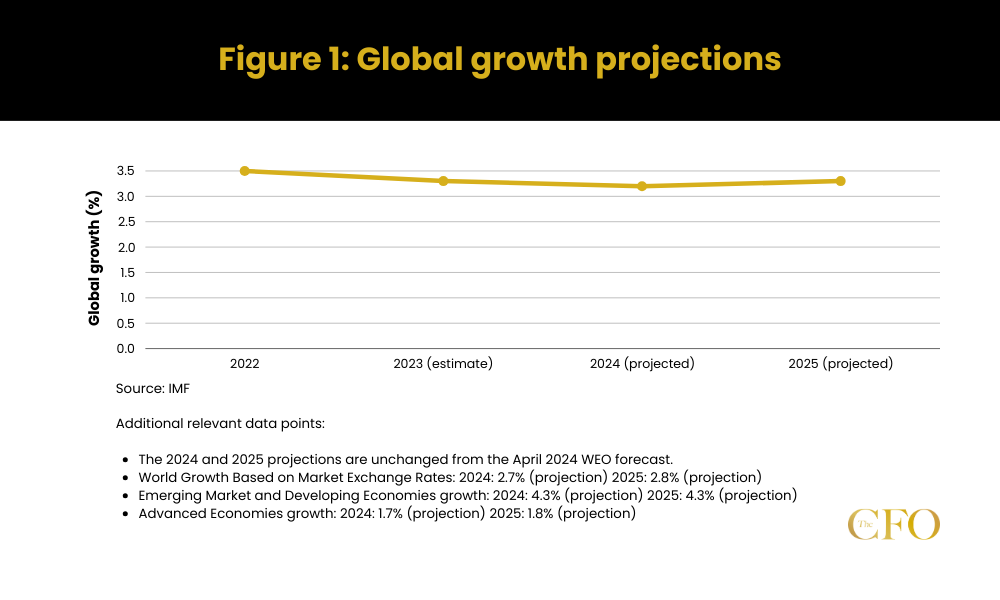

The IMF has held steady its global growth forecast at 3.2% for 2024 and 3.3% for 2025. However, beneath this headline stability lies a tale of diverging fortunes across major economies.

The United States, long the engine of global growth, is expected to see its economy cool, with growth revised down to 2.6% in 2024 and 1.9% in 2025. In contrast, the eurozone shows signs of life, with a modest uptick to 0.9% growth projected for 2024.

China’s economy appears more robust than previously thought, with growth now forecast at 5% for 2024, while India continues to outpace its peers with a projected 7% expansion this year.

Inflation Concerns

Despite progress in taming inflation, the IMF warns that the battle is far from over. The momentum on global disinflation is slowing, particularly in the services sector. This persistence in services inflation, coupled with brisk nominal wage growth in some countries, poses a significant challenge for central banks.

The report highlights that inflation in advanced economies is expected to decline more slowly in 2024 and 2025 than previously anticipated. This trend raises the specter of “higher-for-longer” interest rates, a prospect that could reshape the global financial landscape.

Trade and Financial Markets

World trade is showing signs of recovery, with growth expected to rebound to about 3.25% annually in 2024-25. This uptick, driven by strong exports from Asia, particularly in the technology sector, marks a significant improvement from the near-stagnation observed in 2023.

Financial markets present a mixed picture. While longer-term yields have generally drifted upward, buoyant corporate valuations have kept financial conditions accommodative. This dichotomy underscores the complex interplay between monetary policy expectations and investor sentiment.

The IMF notes that the dollar’s strength, fuelled by interest rate differentials, could disrupt capital flows and complicate monetary policy decisions in emerging markets. This dynamic adds another layer of complexity to the global economic landscape.

Policy Challenges and Recommendations

Central banks face a delicate balancing act. The IMF advises that in countries where upside inflation risks have materialized, monetary authorities should refrain from premature easing and remain open to further tightening if necessary.

Fiscal policy also comes under scrutiny. The report emphasizes the need for careful calibration and sequencing of policy measures. With fiscal space narrowing in many countries, the IMF stresses the importance of adhering to consolidation targets and strengthening fiscal frameworks.

For emerging market and developing economies, managing currency and capital flow volatility emerges as a key priority. The IMF recommends allowing exchange rates to adjust while using monetary policy to keep inflation in check.

Looking Ahead

The IMF report paints a picture of an global economy at a crossroads. While immediate recession fears have receded, the path to sustainable growth remains fraught with challenges.

The potential for significant policy shifts, particularly in light of upcoming elections in several major economies, adds an element of uncertainty to the outlook. The IMF warns that fiscal profligacy and increased protectionism could derail progress and trigger negative spillovers across the global economy.

On a more positive note, the report suggests that policies promoting multilateralism and accelerating structural reforms could boost productivity and growth, with positive ripple effects worldwide.

As the global economy navigates this “sticky spot,” policymakers face the dual challenge of restoring price stability and addressing the legacies of recent crises. The IMF’s message is clear: careful policy calibration, continued vigilance on inflation, and a renewed focus on long-term growth drivers are essential.

For businesses and investors, the outlook suggests a period of continued uncertainty. The prospect of “higher-for-longer” interest rates, persistent inflation pressures, and divergent regional performances will require agile strategies and robust risk management.

As one era of crisis management appears to be winding down, another of careful economic stewardship is just beginning. The global economy’s resilience will be tested as it seeks to transition from recovery to sustainable, balanced growth in an increasingly complex world.