In our latest analysis of palm oil prices, we utilize the Ichimoku Cloud indicator to provide a comprehensive view of market conditions. As of today, the current price of palm oil is trading below the Ichimoku Cloud, indicating a bearish trend in the market. This suggests that sellers have the upper hand, and we may see further downward pressure on prices in the near term.

Key Levels to Watch

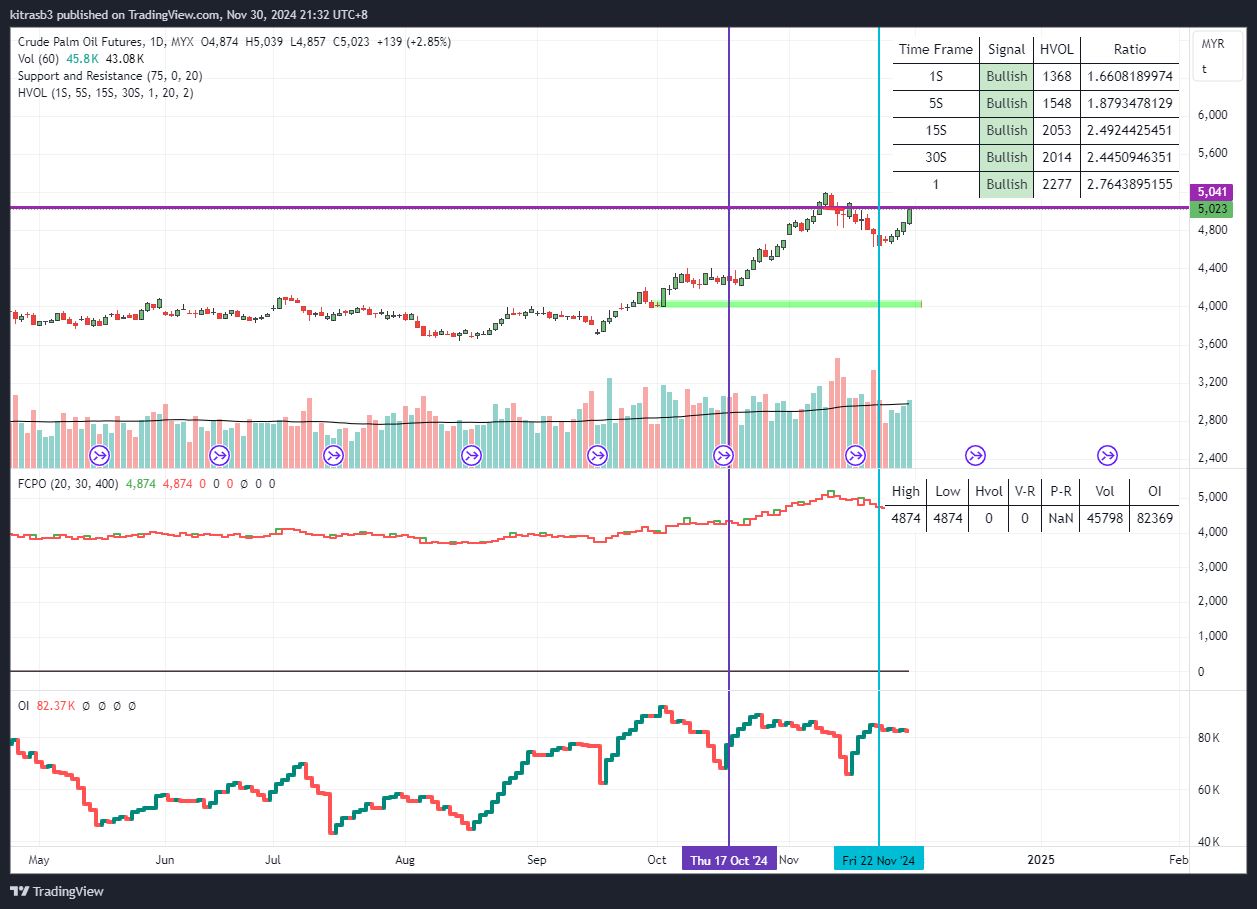

Resistance Level: MYR 4000 The price is currently facing strong resistance around the MYR 4000 level. This resistance is reinforced by the upper boundary of the Ichimoku Cloud, which acts as a ceiling for price movements. Unless there is a significant bullish momentum that pushes the price above this level, we can expect this resistance to hold firm.

Support Level: MYR 3850 On the downside, there is notable support around the MYR 3850 level. This support level is critical as it has previously acted as a floor, preventing prices from falling further. Should the price break below this support, it could signal a continuation of the bearish trend and open the door for further declines.

Ichimoku Cloud Insights

The Ichimoku Cloud, also known as the Kumo, is currently above the price, which is a bearish signal. The thickness of the cloud suggests a strong resistance zone, making it challenging for the price to break through without significant positive catalysts. Additionally, the Lagging Span (Chikou Span) is below the price, further confirming the bearish sentiment.

Conclusion

In summary, the current Ichimoku Cloud analysis of palm oil prices points to a bearish outlook. With resistance at MYR 4000 and support at MYR 3850, traders should closely monitor these key levels. A break above the resistance could indicate a shift in trend, while a break below the support might lead to further declines. As always, stay informed and consider multiple indicators and market conditions before making trading decisions.

Stay tuned for more updates and in-depth analysis on palm oil prices.