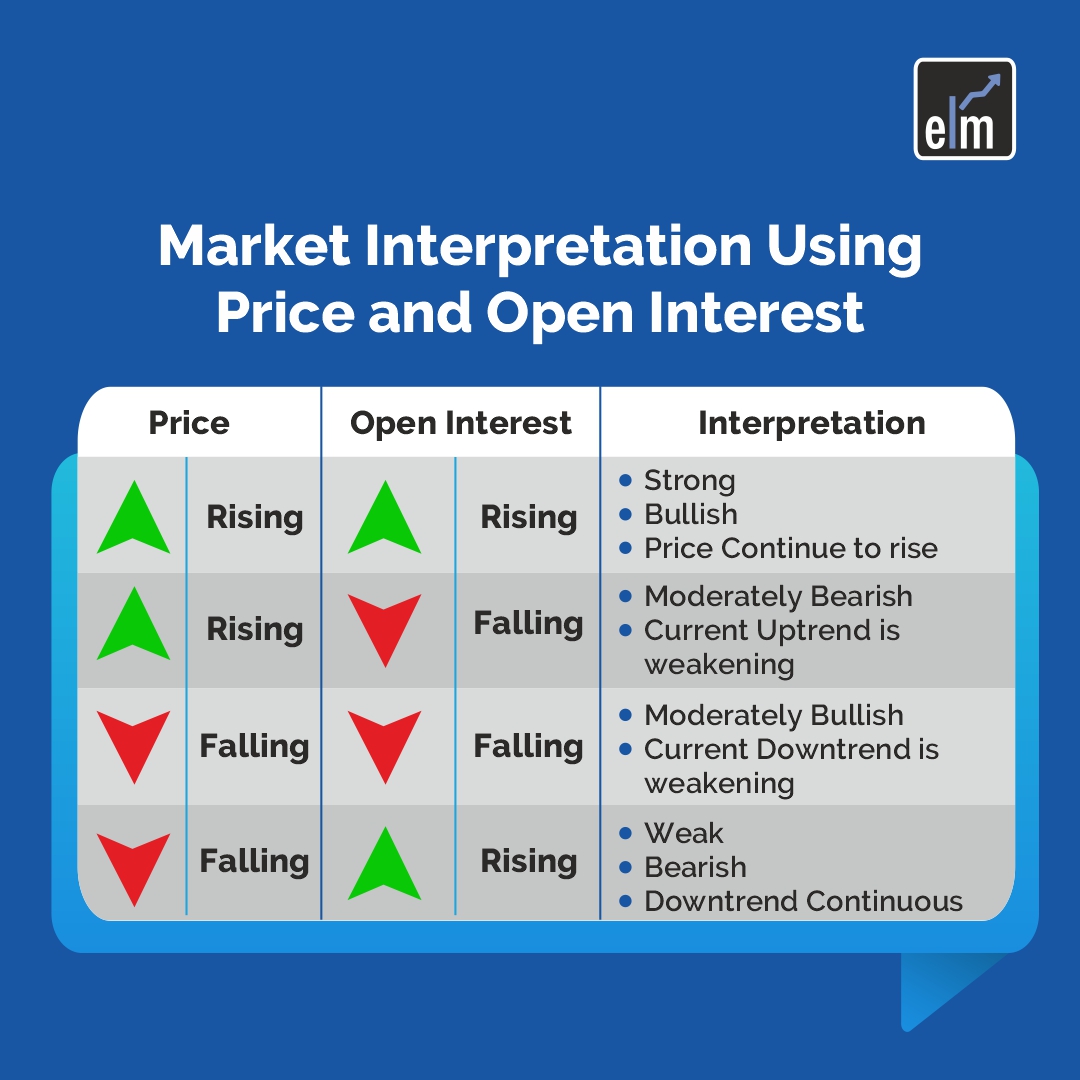

| Price Change | Volume Change | Open Interest Change | Market Implication |

|---|

| Increase | Increase | Increase | Strong Bullish Trend: New money is entering the market, indicating a strong and sustainable bullish trend. |

| Increase | Increase | Decrease | Short Covering: Prices are likely rising due to short sellers covering their positions; the trend may not be sustainable. |

| Increase | Decrease | Increase | Weakening Bullish Trend: Fewer transactions at higher prices may indicate a lack of confidence in the continuing rise. |

| Increase | Decrease | Decrease | Bullish Exhaustion: Suggests the trend is running out of steam and may reverse soon. |

| Decrease | Increase | Increase | Strong Bearish Trend: An increase in trading activity and open interest during a downtrend suggests a strong and potentially sustainable bearish trend. |

| Decrease | Increase | Decrease | Bearish Flush: High volume decline with decreasing open interest may indicate long positions being exited rapidly. |

| Decrease | Decrease | Increase | Weakening Bearish Trend: Less volume on the downside could indicate a decrease in negative sentiment and a potential bottoming out. |

| Decrease | Decrease | Decrease | Lack of Interest in Selling: Indicates a potential reversal upwards as selling pressure diminishes and traders exit their positions. |